The Best Guide To Business Debt Collection

Wiki Article

Debt Collection Agency - Truths

Table of Contents6 Simple Techniques For Personal Debt CollectionWhat Does Dental Debt Collection Mean?The Only Guide for Business Debt CollectionUnknown Facts About International Debt Collection

The financial debt buyer buys just an electronic file of information, typically without sustaining evidence of the financial debt. The debt is additionally normally older financial debt, occasionally described as "zombie debt" due to the fact that the financial obligation customer tries to revitalize a financial debt that was beyond the law of restrictions for collections. Financial obligation debt collector may contact you either in creating or by phone.

But not talking to them will not make the financial debt disappear, and also they may simply try alternative techniques to call you, consisting of suing you. When a financial obligation enthusiast calls you, it is necessary to get some preliminary information from them, such as: The financial debt enthusiast's name, address, and also contact number. The complete quantity of the financial obligation they declare you owe, including any charges and also passion fees that may have accumulated.

The Debt Collection Agency Diaries

The letter has to specify that it's from a financial debt collector. Call and also resolve of both the financial obligation collection agency as well as the debtor. The creditor or creditors to whom the financial obligation is owed. A breakdown of the financial obligation, including costs as well as interest. They must additionally notify you of your legal rights in the financial obligation collection process, and just how you can challenge the financial debt.If you do challenge the financial obligation within thirty day, they should cease collection initiatives until they give you with proof that the financial obligation is yours. They need to offer you with the name and also address of the original creditor if you ask for that information within thirty days. The debt recognition notification need to include a type that can be made use of to call them if you want to dispute the debt.

Some things financial debt enthusiasts can not do are: Make duplicated calls to a debtor, intending to frustrate the borrower. Threaten physical violence. Use obscenity. Lie concerning just how much you owe or make believe to call from an official government workplace. Typically, debt is reported to the credit rating bureaus when it's thirty day overdue.

If your financial debt is transferred to a debt enthusiast or marketed to a debt buyer, an entry will be made on your credit scores report. Each time your financial obligation is offered, if it remains to go unpaid, an additional access will certainly be included to your credit score report. Each unfavorable entry on your debt record can continue to be there for as much as 7 years, also after the financial debt has actually been paid.

The 5-Second Trick For Personal Debt Collection

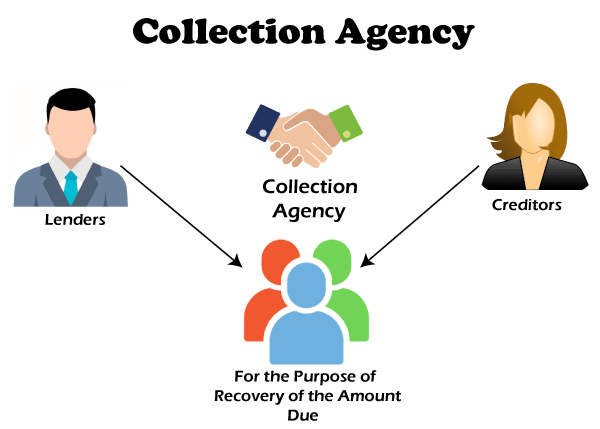

What should you anticipate from a collection firm as well as just how does the procedure work? When you've made the decision to employ a collection firm, make sure you choose the appropriate one.Some are much better at obtaining results from larger companies, while others are knowledgeable at accumulating from home-based services. Make certain you're collaborating with a business that will in fact serve your requirements. This might appear obvious, but before you employ a collection firm, you need to guarantee that they are certified as well as accredited to serve as debt enthusiasts.

Prior to you begin your search, recognize the licensing needs for debt collection agency in your state. This way, when you are speaking with agencies, you can speak smartly about your state's needs. Talk to the companies you talk with to guarantee they satisfy the licensing needs for your state, especially if they are situated elsewhere.

You must additionally contact your Better Company Bureau as well as the Business Debt Collection Agency Association for the names of reliable as well as extremely related to financial debt collection agencies. While you may be passing along these financial obligations to a collector, they are still representing your business. You require to recognize just how they will represent you, how they will certainly collaborate with you, and what pertinent experience they have.

Private Schools Debt Collection Can Be Fun For Anyone

Even if a click over here method is legal doesn't indicate that it's something you want your company name connected with. A respectable financial obligation enthusiast will certainly deal with you to lay out a plan you can live with, one that treats your former clients the means you would certainly want to be treated and also still obtains the job done.If that takes place, one method many agencies special info make use of is avoid mapping. That suggests they have access to certain databases to aid find a borrower who has actually left no forwarding address. This can be a good technique to inquire about specifically. You need to additionally explore the collector's experience. Have they dealt with business in your market prior to? Is your scenario beyond their experience, or is it something they know with? Relevant experience raises the chance that their collection efforts will certainly succeed.

You should have a point of contact that you can connect with as well as get updates from. Business Debt Collection. They need to be able to plainly express what will be anticipated from you at the same time, what details you'll need to provide, and also what the cadence and also causes for communication will certainly be. Your picked company must be able to suit your chosen communication needs, not require you to accept their see this page own

Ask for evidence of insurance from any collection agency to safeguard on your own. Financial obligation collection is a solution, and also it's not a cheap one.

Report this wiki page